RSR

$ 0.005261 USD

$ 0.005261 USD

$ 268.595 million USD

$ 268.595m USD

$ 14.71 million USD

$ 14.71m USD

$ 108.017 million USD

$ 108.017m USD

51.0594 billion RSR

Related information

Issue Time

2019-05-22

Platform pertained to

--

Current price

$0.005261USD

Market Cap

$268.595mUSD

Volume of Transaction

24h

$14.71mUSD

Circulating supply

51.0594bRSR

Volume of Transaction

7d

$108.017mUSD

Change

24h

-6%

Number of Markets

227

Token conversion

Current Rate0

0.00USD

Historical Price

Introduction

Markets

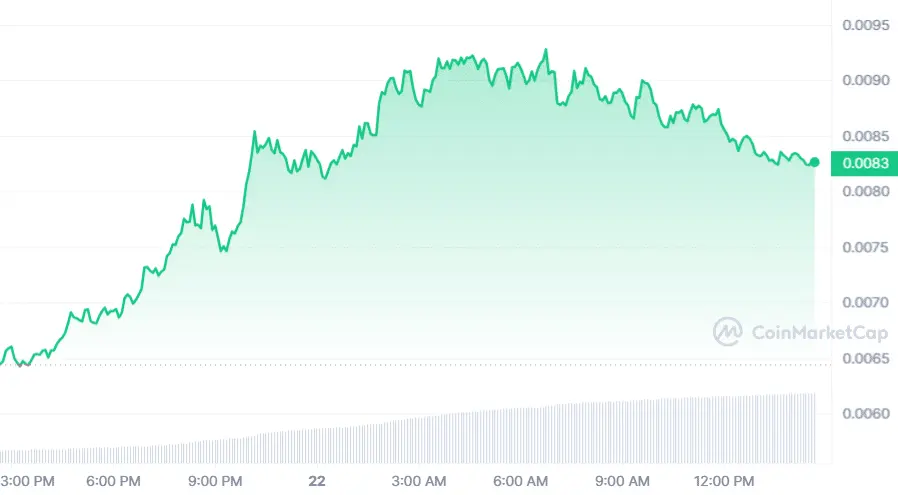

Markets3H

-3.34%

1D

-6%

1W

-8.74%

1M

-15.42%

1Y

+159.92%

All

+43.7%

| Aspect | Information |

|---|---|

| Short Name | RSR |

| Full Name | Reserve Rights Token |

| Founded Year | 2017 |

| Main Founders | Nevin Freeman, Matt Elder |

| Support Exchanges | Binance, Huobi Global, OKEx, BitZ, Upbit |

| Storage Wallet | MyEtherWallet, Ledger, Trezor, MetaMask |

Overview of RSR

Reserve Rights Token (RSR) is a type of cryptocurrency that was established in 2017. The token is co-founded by Nevin Freeman and Matt Elder. This cryptocurrency is supported by various exchanges including Binance, Huobi Global, OKEx, BitZ, and Upbit. In terms of storage, the tokens can be kept in various wallets such as MyEtherWallet, Ledger, Trezor, and MetaMask. It is predominantly utilized to maintain the stability of Reserve's stablecoin, the Reserve Stablecoin (RSV). It aims to play a role in the broader digital currency ecosystem by providing additional utility and functionality.

Pros and Cons

| Pros | Cons |

|---|---|

| Supported by multiple exchanges | Relatively new in the cryptocurrency market |

| Can be stored in various wallets | Limited number of partners and relationships |

| Role in maintaining stability of Reserve's stablecoin | Dependence on broader adoption of Reserve's stablecoin |

| Has potential utility in the digital currency ecosystem | Market volatility may affect token value |

Pros of RSR Token:

1. Supported by Multiple Exchanges: RSR Token is recognized and supported by a number of prominent exchange platforms, including Binance, Huobi Global, OKEx, BitZ, and Upbit. This allows for increased liquidity for users and potentially opens up the token to a wider pool of traders and investors.

2. Diverse Storage Options: RSR tokens can be stored in a variety of different wallets, including MyEtherWallet, Ledger, Trezor, or MetaMask. This gives users flexibility in terms of how and where they can securely store their tokens.

3. Role in Stablecoin Stability: The primary function of RSR tokens is to maintain the stability of Reserve's stablecoin, the Reserve Stablecoin (RSV). This could be seen as a unique selling proposition of RSR, as it directly contributes to maintaining the stable value of RSV.

4. Potential Utility: The potential utility of RSR in the broader digital currency ecosystem is another significant advantage. The developers of RSR plan for it to play a larger role in decentralized finance (DeFi) and various other blockchain ecosystems.

Cons of RSR Token:

1. Newcomer Status: Since the RSR Token was only established in 2017, it is relatively new compared to other cryptocurrencies. This might result in a lower level of recognition and credibility in the crypto community, compared to more established tokens.

2. Limited Partnerships: Currently, RSR Token has limited partnerships and relationships compared to other cryptocurrencies. This could potentially limit the usability and acceptance of the token.

3. Dependence on Stablecoin Adoption: The value proposition of RSR is in large part dependent on the broader adoption and success of Reserve's stablecoin. If the stablecoin is not widely adopted, this could limit the utility and value of RSR.

4. Market Volatility: Like all cryptocurrencies, the value of RSR is highly volatile. Fluctuations in the token's value could be more pronounced due to its relatively recent entry into the market.

What Makes RSR Unique?

The Reserve Rights Token (RSR) introduces a novel model in the cryptocurrency arena, as it serves a specific role in maintaining the stability of another token, the Reserve Stablecoin (RSV). This two-token model is an innovative approach as most cryptocurrencies function independently.

RSR is used to ensure that the stablecoin (RSV) achieves its intended function of being a stable digital asset. Stablecoins are often pegged to fiat currencies or other assets to maintain their value, however, RSR has a different mechanism where it is used to maintain the stability of RSV.

Another distinguishing aspect of RSR is its intended broader utility in the digital currency ecosystem, such as its potential role in decentralized finance (DeFi). This positions RSR with a potentially unique position among other utility tokens.

However, it's important to note that while these aspects set RSR apart, it also shares common characteristics with many other cryptocurrencies. For example, it's dependent on market demand, its price is subject to volatility, and it relies on blockchain technology for transactions.

Moreover, the success of RSR's model — maintaining the stability of a stablecoin — does largely hinge on the adoption and success of the RSV. That said, these facets of RSR contribute to its unique position within the cryptocurrency landscape. Still, the response from the marketplace and the token's developing role within the digital economy will ultimately determine its long-term utility and value.

Circulation of RSR

Circulating Supply of RSR

The circulating supply of RSR is the total number of RSR tokens that are available for trading and use. This number is currently 50.6 billion RSR. The total supply of RSR is 100 billion tokens, but the remaining tokens are not yet in circulation.

Price Fluctuation of RSR

The price of RSR has fluctuated significantly since its launch in 2020. It reached an all-time high of $0.0202 in May 2021, but has since fallen to its current price of around $0.0019.

There are a number of factors that can affect the price of RSR, including:

Overall market conditions: The cryptocurrency market is volatile and the price of RSR is likely to track the overall market trend.

Demand for RSR: Demand for RSR will increase if more people start using the Reserve Rights platform or if they believe that the price of RSR will go up in the future.

Supply of RSR: The supply of RSR will increase over time as more tokens are released into circulation. This could lead to a decrease in the price of RSR, all else being equal.

News and events: Positive news about the Reserve Rights project or the cryptocurrency market as a whole could drive up the price of RSR. Negative news could have the opposite effect.

Correlation between Circulating Supply and Price Fluctuation

There is a general inverse correlation between circulating supply and price fluctuation. This means that when the circulating supply of a token increases, the price tends to go down. When the circulating supply decreases, the price tends to go up.

This is because an increase in circulating supply makes the token more available to buyers, which can lead to a decrease in price. Conversely, a decrease in circulating supply makes the token less available to buyers, which can lead to an increase in price.

However, it is important to note that this correlation is not always perfect. There are other factors that can affect the price of a token, such as utility, speculation, and news and events.

Circulating Supply and Price Fluctuation of RSR in 2023

The circulating supply of RSR is expected to continue to increase in 2023, as more tokens are released into circulation. This could lead to a decrease in the price of RSR, all else being equal.

However, the project team is also working on initiatives to increase the demand for RSR, such as developing new features for the Reserve Rights platform and expanding its partnerships.

The future price of RSR will depend on a number of factors, including the overall state of the cryptocurrency market, the success of the project team's initiatives, and news and events.

Conclusion

The circulating supply of RSR is one of the factors that can affect its price. However, it is important to note that there are other factors that can also affect the price of RSR, such as utility, speculation, and news and events.

How Does RSR Work?

The Reserve Rights Token (RSR) operates within a dual token system along with the Reserve Stablecoin (RSV). This system has been designed to maintain RSV's stability, as well as to ensure the token's value remains as close to $1 USD as possible. Here's how it works:

1. When the price of RSV falls below $1, the system purchases RSV tokens using RSR. This reduces the supply of RSV in the marketplace, which in theory should help to increase the price of RSV back to its intended $1 value.

2. Conversely, if the RSV price goes above $1, the system mints and sells more RSV. This should increase the supply of RSV in the market and help to decrease the price of RSV back to its intended value.

3. In times of a significant market downturn, additional RSR tokens can be sold to raise money if necessary.

While this setup is unique to the Reserve Rights Token, it's also important to understand that the stability of the Reserve Stablecoin (and, thus, the efficacy of RSR's mechanisms) depends on the acceptance and usage of RSV. If RSV fails to achieve widespread adoption or acceptance, it could affect the utility and value of RSR.

Exchanges to Buy RSR

RSR token is supported by various exchanges, allowing trading in a range of currency pairs or token pairs. Here are ten examples of such exchanges:

1. Binance: It supports trading pairs RSR/USDT, RSR/BTC and RSR/BUSD. Binance possesses one of the largest ranges of available cryptocurrencies for trading, and offers options for both beginner and advanced level traders.

2. Huobi Global: This exchange platform supports trading pairs in RSR/USDT and RSR/BTC. Huobi is recognized for its international reach, offering its services in several countries.

3. OKEx: Supports trading pairs in RSR/USDT, RSR/BTC and RSR/ETH. OKEx is known for offering a vast range of digital assets for trading.

4. BitZ: BitZ supports the trading pair RSR/USDT. It's known for its multi-tier security system and providing a user-friendly environment.

5. Upbit: Here, the supported trading pair is RSR/KRW. Upbit is popular in South Korea and provides an extensive range of cryptocurrency trading options.

6. Hotbit: Hotbit supports the trading pairs RSR/USDT, RSR/ETH. This exchange is known for a wide range of digital assets availability.

7. HitBTC: This exchange supports the RSR/BTC trading pair. HitBTC is known for providing advanced security features and a robust platform for trading.

8. Bithumb: Here, the supported trading pair is RSR/KRW. Bithumb is one of the most popular exchanges in South Korea, known for its intuitive user interface.

9. KuCoin: On KuCoin, you can trade RSR/USDT. KuCoin is popular due to its extensive liquidity and variety of cryptocurrencies.

10. MXC: MXC supports the trading pairs RSR/USDT. This digital asset trading platform is known for offering a range of cryptocurrencies for trading.

Please note, the selection of trading pairs can vary depending upon the exchange, and it's always wise to check the current listings direct with the exchange.

How to Store RSR?

RSR tokens can be stored in several types of wallets, each offering different features. They fall under various categories as mentioned below:

1. Web Wallets Browser Extensions:Web wallets, such as MetaMask, run as a browser extension and provide a balance between security and ease of use. They're excellent for daily transactions and participating in DeFi platforms, but they should not be used for storing large amounts of cryptocurrencies due to potential vulnerabilities associated with internet connections.

2. Mobile Wallets: Mobile wallets like Coinbase Wallet offer convenience and enhanced accessibility as they allow users to access and transact their RSR tokens from their smartphones. However, the security depends on the protection measures on the phone and the wallet app itself.

3. Hardware Wallets: Hardware wallets such as Ledger and Trezor provide the highest security for storing cryptocurrencies. They store the user's private keys in a protected area of a microcontroller, and they cannot be transferred out of the device in plaintext, which makes them immune to computer viruses that steal from software wallets.

4. Desktop Wallets: Desktop wallets are downloaded and installed on a PC or laptop. They are accessible from the machine on which they were downloaded. Wallets like Exodus, which supports RSR tokens, provide control over the private keys and offer a high-security level.

Remember, regardless of the wallet used, it is essential to keep the software up to date, use strong/different passwords for different wallets, back up the wallet, and keep recovery phrases secure.

Should You Buy RSR?

As with any investment, whether or not someone is suitable to buy Reserve Rights Tokens (RSR) depends on their individual financial situation, risk tolerance, investment goals, and understanding of the cryptocurrency market. Here are some factors that might inform someone's decision:

1. Crypto Market Understanding:RSR, like all cryptocurrencies, operates within a distinct and rapidly evolving market ecosystem. It's crucial to have a solid understanding of how the crypto market works before investing in RSR or any other cryptocurrency. One must understand the inherent volatility of these investments and the technology underlying it.

2. Financial Risk Tolerance: Cryptocurrencies are often much more volatile than traditional fiat currencies. This means the price of a cryptocurrency can change rapidly in a very short time, making it possible for investors to experience significant gains or losses. Investors should assess their risk tolerance before engaging in such investments.

3. Interest in Reserve's Mission: Investors inclined towards utilizing blockchain technology to achieve stabilized global economies might also find RSR an interesting prospect, as Reserve aims to create a universal store of value (RSV) with the help of RSR.

4. Long-term vs Short-Term: The potential value of RSR will ultimately be tied to the adoption and success of the Reserve Protocol‘s stablecoin. Therefore, investors with a long-term orientation, who believe in the protocol’s mission and growth potential, may find RSR more appropriate than those looking for short-term gains.

Remember, this advice is general in nature and doesn't take into account individual needs and circumstances. Potential investors should seek independent financial advice and thoroughly research RSR before deciding whether to buy.

Conclusion

The Reserve Rights Token (RSR) is an innovative player in the cryptocurrency landscape, operating in a unique dual token system with the Reserve Stablecoin (RSV) to maintain the latter's stability. Established in 2017, RSR could potentially play a significant role in the digital currency ecosystem, contributing to the growing field of decentralized finance (DeFi).

RSR is supported by various exchanges and can be stored in a diverse range of wallets, enabling a degree of flexibility for users. As is the case with any investment, the prospect of making money or seeing appreciation in the value of RSR is contingent upon numerous variables, including market demand, levels of RSV adoption, and macroeconomic factors.

The future growth of RSR rests largely on the widespread adoption and successful functionality of RSV. It's also dependent on the overall growth and adoption of cryptocurrencies and DeFi more broadly.

It is crucial to note the potential for volatility in the crypto market and the inherent risks associated with investing in cryptocurrencies. Potential investors should conduct thorough research and perhaps seek independent financial advice before entering such investments.

FAQs

Q: What are some of the most popular exchanges that list RSR for trading?

A: Notable exchanges that list RSR include Binance, Huobi Global, OKEx, BitZ, and Upbit, among others.

Q: How can I securely store my RSR tokens?

A: RSR tokens can be securely stored in a variety of wallets, such as MyEtherWallet, Ledger, Trezor, and MetaMask.

Q: What differentiates Reserve Rights Token from other cryptocurrencies?

A: RSR is unique in its role as a stabilizing entity for another token (RSV), working within a dual-token system, unlike most cryptocurrencies which function independently.

Q: How does the value of RSR potentially increase?

A: The value of RSR can potentially rise if there's an increase in the adoption and success of the Reserve Protocol's stablecoin RSV, amongst other market conditions.

Q: What are some considerations for potential RSR investors?

A: Potential RSR investors should consider their understanding of the crypto market, financial risk tolerance, alignment with Reserve's mission, and evaluate their investment time horizon before investing.

Q: Is there an opportunity for short-term gains with RSR?

A: As with any cryptocurrency, there may be opportunities for short-term gains, however, the value of RSR is largely tied to the long-term adoption and success of the Reserve Protocols stablecoin.

Q: What's the stance on RSR's future growth?

A: The development prospects of RSR hinge largely on the successful functionality and widespread adoption of Reserve's stablecoin and the growth and acceptance of cryptocurrencies and DeFi at large.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

Trading Products

- 1

- 2

- 3

- 4

User Reviews

News

TokenCrypto analysis: Celestia (TIA), Polygon (MATIC) and Reserve Rights (RSR)

In this article, we see all the latest news for the crypto projects Celestia (TIA), Polygon (MATIC),

2024-07-05 20:13

TokenReserve Rights (RSR) Price Surges 52% – Sustainable or Short-Lived?

Reserve Rights (RSR) price is one of the many cryptocurrencies that have charted astonishing rallies

2024-03-22 20:45

TokenRSR token soars by 30% to new price heights

The Reserve Rights (RSR) token has surged by 30% in the last 24 hours, setting it apart as one of th

2024-03-22 19:47

Industry Stablecoin payment app Reserve helps individuals protect their savings against inflation in Latin America

Over 8,000 businesses, predominantly based in Venezuela, now accept RSV to pay for goods and services.

2021-11-11 18:35

3 ratings