LCC

$ 0.0057 USD

¥ 0.0410 CNY

$ 4.574 million USD

¥ 33.147m CNY

$ 19.07 USD

¥ 138.19 CNY

$ 394.64 USD

¥ 2,859.69 CNY

799.784 million LCC

Related information

Issue Time

2018-02-22

Platform pertained to

--

Current price

$0.0057USD

Market Cap

¥33.147mCNY

Volume of Transaction

24h

¥138.19CNY

Circulating supply

799.784mLCC

Volume of Transaction

7d

¥2,859.69CNY

Change

24h

0.00%

Number of Markets

9

Token conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

Historical Price

Introduction

Markets

Markets3H

0.00%

1D

0.00%

1W

0.00%

1M

-20.17%

1Y

+8.99%

All

+58.29%

| Aspect | Information |

|---|---|

| Short Name | LCC |

| Full Name | Litecoin Cash |

| Founded Year | 2018 |

| Main Founders | Unspecific |

| Supported Exchanges | Yobit, Mercatox, SouthXchange |

| Storage Wallet | LCC Official Wallet, Coinomi |

Overview of LCC

Litecoin Cash (LCC) is a cryptocurrency that was launched in 2018. The focused vision was to create a Litecoin fork that would, in many ways, outstrip its predecessor. LCC was not founded by an individual or specific team but rather emerged from a broader digital community. LCC can be traded on a number of exchanges, including but not limited to Yobit, Mercatox, and SouthXchange. It'd be safekeeping your LCC tokens in the official LCC wallet or other supported storage options such as Coinomi.

Pros and Cons

| Pros | Cons |

|---|---|

| Low transaction fees | Less known in the market |

| Fast transaction speed | Inconsistent market value |

| Supported by various exchanges | Limited acceptance for goods and services |

| Diverse storage options | Relatively new with undeveloped infrastructure |

Here's the detailed description of the pros and cons points mentioned in previous conversation about LCC token:

Pros:

1. Low transaction fees: LCC is known for its low transaction fees which provides an advantage for users when performing transactions, this means it may be more cost effective for various transactions compared to other cryptocurrencies.

2. Fast transaction speed: The speed of transactions with LCC is relatively high compared to some other cryptocurrencies. This means transactions can be processed and completed quickly, which can be beneficial for both individual users and businesses.

3. Supported by various exchanges: LCC can be exchanged through various platforms including Yobit, Mercatox, and SouthXchange. This gives users options and flexibility when choosing a market to trade or invest their tokens.

4. Diverse storage options: For storing LCC tokens there are multiple options available. Users can use the official LCC wallet, or they can use other supported wallets, such as Coinomi. This gives users the freedom to choose a wallet that best fits their needs.

Cons:

1. Less known in the market: Despite the potential it has, LCC is not as well known in the market compared to more mainstream cryptocurrencies. This could impact its adoption rate and growth potential.

2. Inconsistent market value: The value of LCC tends to be inconsistent. While this is not unique to LCC and is common with many cryptocurrencies, it can deter certain investors seeking more stability.

3. Limited acceptance for goods and services: Currently, LCC is not widely accepted as a form of payment for goods and services. This limits its use case and could impede its widespread adoption.

4. Relatively new with undeveloped infrastructure: As LCC is relatively newer compared to other established cryptocurrencies, it is still developing its underlying infrastructure. This might result in uncertainties and possible technical issues in the future.

What Makes LCC Unique?

Litecoin Cash (LCC) is a derivative of the original Litecoin cryptocurrency, and presents several innovative changes. One of the key distinguishing features of LCC is the implementation of the SHA-256 hashing algorithm, rather than the Scrypt algorithm used by Litecoin. This allows for a broader range of mining hardware to be used in the LCC network.

Another notable difference is that LCC offers faster block generation times. While Bitcoin and Litecoin have block generation times of 10 minutes and 2.5 minutes respectively, LCC's block generation time is a mere 2 minutes. This potentially leads to faster transaction processing times. However, it's important to note that faster block times can also result in smaller block rewards for miners, and might lead to higher blockchain bloat.

In addition, LCC emphasizes low transaction fees. While precise fees can fluctuate based on network conditions, this focus has the potential to make small transactions, micropayments, or day-to-day retail use more economical when using LCC.

However, like many other digital currencies, LCC faces challenges related to market adoption, acceptance for goods and services, and infrastructure development. Furthermore, the value of LCC remains inconsistent, which could affect its perceived onset of risks, particularly for risk-averse investors.

How Does LCC Work?

Litecoin Cash (LCC) operates using the proof-of-work (PoW) consensus mechanism, much like Bitcoin and its predecessor Litecoin. However, in contrast to these other cryptocurrencies, it uses a SHA-256 hashing algorithm. This means that it can support a wide range of mining equipment, such as those used in Bitcoin mining. It has, as a result, a more inclusive mining community, and more security provided by the greater network hashing power.

The general principle behind LCC, like other cryptocurrencies, is to facilitate peer-to-peer transactions via a decentralized network. Transactions made on the network are compiled into “blocks”, which are then cryptographically verified for authenticity and linked to the existing blockchain.

As for the specific working mode of LCC, it targets a 2-minute block time. This means that approximately every two minutes, a new block of transactions is added to the LCC blockchain. Furthermore, this faster block time allows for quicker transaction confirmations.

However, the 2-minute block generation time could potentially lead to blockchain bloat. Lastly, even though one of the goals of LCC is to maintain low transaction fees, the exact fee can fluctuate based on network congestion and transaction size.

It's important to note, however, that despite these functions and objectives, the market adoption of LCC is still growing, and there is inconsistent acceptance of LCC as payment for goods and services. Additionally, like most cryptocurrencies, the value of LCC can be highly volatile.

Circulation of LCC

The current circulating supply of Litecoin Cash (LCC) is 792 million. This means that 792 million LCC tokens have been released to the public and are available to be bought, sold, or used.LCC is a cryptocurrency that is forked from Litecoin. It was launched in 2018 and is designed to be a faster and more scalable cryptocurrency than Litecoin. LCC tokens can be used to purchase goods and services from merchants who accept it, and it can also be traded on exchanges.

Exchanges to Buy LCC

There are multiple exchanges that support the buying and trading of Litecoin Cash (LCC). However, please note that these listings often change due to market conditions, so it is advisable to check the exchanges for the most up-to-date information:

1. Yobit: Yobit offers trading pairs that include LCC/USD, LCC/BTC, and LCC/ETH.

2. Mercatox: On Mercatox, LCC can be traded against BTC and ETH.

3. SouthXchange: SouthXchange supports LCC/BTC trading pair.

4. Binance: Although not directly available, LCC can be traded on Binance by first converting LCC to BTC on a supported exchange and then transferring for further trading.

5. Coinbase: Like Binance, Coinbase does not directly support LCC, however, users can transfer converted LCC (to BTC or ETH) for trading purposes.

6. Huobi: Huobi does not directly list LCC but users can convert their LCC to supported coins (like BTC/ETH) and trade.

7. OKEx: OKEx does not directly list LCC. Users may convert LCC to a supported form (like BTC/ETH) and then carry out trading activities.

8. Bitfinex: On Bitfinex, you won't find LCC directly listed. However, you can convert LCC to BTC or ETH on a supported exchange, then transfer it to Bitfinex.

9. Kraken: Kraken does not directly list LCC. Users can convert their LCC to BTC or ETH on a supported exchange, then transfer these to Kraken for trading.

10. Poloniex: Poloniex does not directly support LCC, but users can convert LCC to supported trading pairs like BTC or ETH on a listed exchange for trading.

Please do not treat this information as financial advice but rather a basic understanding of certain exchanges and their procedures. Always conduct your own research before making investment decisions.

How to Store LCC?

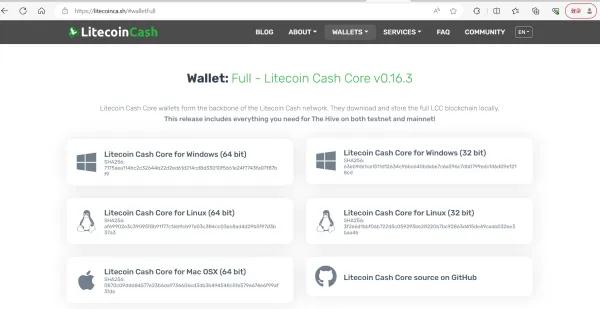

Storing Litecoin Cash (LCC) can be done in several ways depending on the type of wallet you choose to use. Wallets are essentially the tools that allow you to interact with various blockchain networks. They can store your public and private keys and enable you to send or receive cryptocurrencies.

Here are some wallet types where LCC can be stored:

1. Desktop Wallets: These are installed on a PC or laptop. They offer complete control over the wallets and are secure. The official LCC wallet which can be downloaded from the official website of Litecoin Cash falls into this category.

2. Mobile Wallets: These are run from applications on a smartphone. They provide utility and convenience as you can perform transactions anywhere. A popular mobile wallet for LCC is Coinomi.

3. Hardware Wallets: These are physical devices that can store cryptocurrencies. These offer high security as they can be disconnected from the internet when not in use. Unfortunately, as of now, no well-known hardware wallets support LCC.

Before selecting a wallet, it is crucial to ensure it is trustworthy and to understand the safety features it provides. Always remember that securing your private keys and keeping backups is of utmost importance when managing cryptocurrencies. Your chosen wallet should ideally support these security measures.

Lastly, always conduct your own research before entrusting your tokens to any wallet. This can include checking reviews, understanding where the wallet is storing your private keys, and ensuring the wallet is reputable. These steps will help ensure the safety of your LCC tokens.

Should You Buy LCC?

Investing in Litecoin Cash (LCC), or any type of cryptocurrency, can be a suitable investment for individuals who have a good understanding of the digital currency market. These individuals are generally technologically savvy and are comfortable with the fluctuating, speculative, and unregulated nature of the cryptocurrency market.

Potential investors should consider the following points:

1. Risk Tolerance: The value of LCC, like other cryptocurrencies, can fluctuate drastically. Investors should have a high risk tolerance and not invest more than they can afford to lose.

2. Market Understanding: Investors should have a basic understanding of how cryptocurrency markets work, including the factors that influence the price of cryptocurrencies. It is also crucial to understand how to use exchanges to buy and sell cryptocurrencies.

3. Technological Knowledge: A decent grasp of blockchain technology can help understand the purpose and potential value of a cryptocurrency. Knowledge about different types of wallets and security measures is also vital for storing cryptocurrencies safely.

4. Research: Before investing, it's advisable to research widely and evaluate the strengths and weaknesses of LCC. This should include understanding the technology behind LCC, the problem it addresses, and its potential growth.

5. Diversification: Investing in a single type of asset is often riskier than diversifying investments. Balancing investments across different asset classes can help mitigate potential losses.

Remember that this is not financial advice, and investing in cryptocurrencies carries risk. It is always recommended to seek advice from a licensed financial advisor and conduct thorough research before investing in any cryptocurrency.

Conclusion

Litecoin Cash (LCC) is a digital currency that emerged in 2018 as a fork from the original Litecoin. It implemented changes such as the use of the SHA-256 algorithm and faster block generation times, positioning itself for potentially more efficient and inclusive mining. LCC can be bought and traded across a range of exchanges, and stored in various wallet options.

However, like many other cryptocurrencies, its market value is inconsistent and its growth potential could be impacted due to limited acceptance as payment for goods and services. Furthermore, its infrastructure, being relatively new, is still in development and could lead to uncertainties and potential technical issues.

As for the profitability and appreciation potential of LCC, it's important to note that all investments carry risk, especially so in the volatile market of cryptocurrencies. While there is the possibility of making money, fluctuations in value are equally possible, which could lead to losses.

The future development and growth of LCC are dependent upon its adoption level, technological advancements, competition from other cryptocurrencies, regulatory environment, and overall market conditions. For any potential investor, a thorough understanding of these factors, coupled with careful risk assessment and diversification strategy, is essential.

FAQs

Q: From what blockchain did Litecoin Cash (LCC) fork occur?

A: LCC emerged from a fork in the original Litecoin blockchain.

Q: What consensus mechanism does Litecoin Cash (LCC) utilize?

A: LCC operates on a proof-of-work (PoW) consensus mechanism.

Q: What mining algorithm is used in the Litecoin Cash (LCC) network?

A: LCC implements the SHA-256 algorithm for mining processes.

Q: Who founded Litecoin Cash (LCC)?

A: LCC does not have specific individual founders but originated from a wider digital community.

Q: How can I buy Litecoin Cash (LCC)?

A: You can purchase LCC on multiple exchanges including platforms like Yobit, Mercatox, and SouthXchange.

Q: Where can I store my LCC tokens?

A: LCC tokens can be securely stored in the official LCC wallet or other compatible options such as Coinomi.

Q: What transaction speed can I expect with LCC?

A: LCC aims to uphold a fast transaction speed with a target 2-minute block generation time.

Q: How stable is the value of the LCC token?

A: The value of the LCC token is highly volatile and can fluctuate drastically, like many other cryptocurrencies.

Q: In which exchanges can I trade LCC?

A: LCC tokens can be traded on several exchanges, such as Yobit, Mercatox, and SouthXchange.

Q: Can I use hardware wallets to store my LCC tokens?

A: Currently, no major hardware wallets support LCC.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

Trading Products

- 1

0 ratings