UP

$ 0.8928 USD

$ 0.8928 USD

$ 4,309 0.00 USD

$ 4,309 USD

$ 0 USD

$ 0.00 USD

$ 62.97 USD

$ 62.97 USD

0.00 0.00 UP

UniFi Protocol-related information

Issue Time

2000-01-01

Platform pertained to

--

Current coin price

$0.8928USD

Market Cap

$4,309USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00UP

Volume of Transaction

7d

$62.97USD

Change

24h

+11.26%

Number of Markets

10

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

UP Price Chart

UniFi Protocol introduction

Markets

Markets3H

+5.45%

1D

+11.26%

1W

+10.11%

1M

-3.87%

1Y

-21.67%

All

+99.41%

UniFi Protocol is a decentralized finance (DeFi) protocol designed to foster interoperability between different blockchains. Its native token, UNFI, plays a crucial role in the ecosystem, providing governance rights, staking rewards, and access to exclusive features.

Why it's the best token

The UniFi Protocol (UNFI) token has attracted much attention for its innovative cross-chain interoperability, which allows DeFi products between different blockchains to connect to each other, providing a powerful tool for the development of decentralized finance. The UNFI token is the governance and staking token of the Unifi Protocol DAO. Holders can participate in platform governance and receive rewards through staking. Holders of UNFI tokens can also enjoy rights and interests such as trading discounts. Unifi Protocol DAO is a decentralized autonomous organization founded by the Sesameseed team to promote the widespread application of blockchain technology, especially in the multi-chain field. The market value and trading volume of the UNFI token demonstrate its activity in the market and investor recognition, and its price forecast also shows positive growth potential.

Token address

The UniFi Protocol Token (UNFI) is listed on various blockchains with different addresses. For instance, on the Ethereum Network, the UNFI ERC-20 token contract address is `0x441761326490cACF7aF299725B6292597EE822c2`, and on the Binance Smart Chain Network, the BEP-20 token contract address is `0x728C5baC3C3e370E372Fc4671f9ef6916b814d8B` . It's essential to verify the correct token address on the respective blockchain when interacting with UNFI tokens.

Token transfer

Transferring UniFi Protocol (UNFI) tokens involves using a compatible wallet that supports the blockchain network where the UNFI token is hosted. To initiate a transfer, you must enter the recipient's wallet address, the amount of UNFI tokens you wish to send, and potentially a transaction fee. Always double-check the token contract address to ensure the correct destination, and confirm all details before finalizing the transaction to avoid loss of funds. Remember to adhere to the specific network's transfer protocols and requirements.

Cryptocurrency wallets

When it comes to storing your UniFi Protocol tokens, you have a few options. The best wallet for you will depend on your specific needs and preferences. Here are some popular choices:

Hardware Wallets: These offer the highest level of security, storing your private keys offline. Examples include Ledger Nano S and Trezor.

Software Wallets: Software wallets can be desktop-based, mobile-based, or browser-based. Popular options include MetaMask, Trust Wallet, and the official UniFi Wallet (if available).

Exchange Wallets: If you purchased your UniFi tokens on an exchange like Binance or Coinbase, you can store them in the exchange wallet. However, be aware that you're giving up control of your private keys.

Online purchase of USD/USDT

To purchase UniFi Protocol (UNFI) tokens in the USA using USDT, you can follow these steps:

1. Choose a cryptocurrency exchange that supports UNFI and USDT trading pairs. Popular exchanges may include centralized platforms like Binance or decentralized ones that list UNFI .

2. Complete the necessary Know Your Customer (KYC) process on the exchange if you haven't already.

3. Deposit USDT into your exchange wallet.

4. Navigate to the UNFI/USDT trading pair on the exchange.

5. Place an order to buy UNFI tokens with your USDT at the current market price or a limit price you set.

6. Once your order is filled, you can choose to hold the UNFI tokens in the exchange or transfer them to a personal wallet for safekeeping.

Buying with loans/financing

Borrowing and Lending with UniFi Protocol

UniFi Protocol offers a decentralized lending platform that allows users to borrow and lend a variety of crypto assets. This feature is a cornerstone of DeFi, providing a more flexible and accessible way to manage your crypto holdings.

Key Features of UniFi's Lending Platform:

Over-collateralized Loans: To borrow assets on UniFi, you typically need to provide collateral that exceeds the value of the loan. This ensures that the platform remains solvent.

Variety of Assets: UniFi supports a wide range of cryptocurrencies as both collateral and borrowable assets, giving you flexibility in your borrowing and lending strategies.

Liquidation Mechanism: If the value of your collateral drops below a certain threshold, your position may be liquidated to protect the platform.

Interest Rates: Interest rates on loans fluctuate based on market supply and demand.

Benefits of Using UniFi for Lending and Borrowing:

Decentralization: Your funds are held in a decentralized protocol, reducing counterparty risk.

Transparency: All transactions and interest rates are publicly visible on the blockchain.

Accessibility: You can access the platform from anywhere with an internet connection.

UniFi Protocol User Reviews

UniFi Protocol News

TokenCrypto Market Review: Shiba Inu Price Momentum Returns In New Uptrend, Is Ethereum (ETH) Stuck in the Mud? Bitcoin Isn't Giving Up on $70,000

A long stretch of quiet price action seems to be coming to an end for Shiba Inu, as volatility slowl

2026-02-21 10:02

ExchangeLightspark Teams Up with Cross River Bank for Fiat Payments via Bitcoin

Lightspark, a Bitcoin Lightning Network startup founded by former Meta executive David Marcus, who o

2026-02-21 04:00

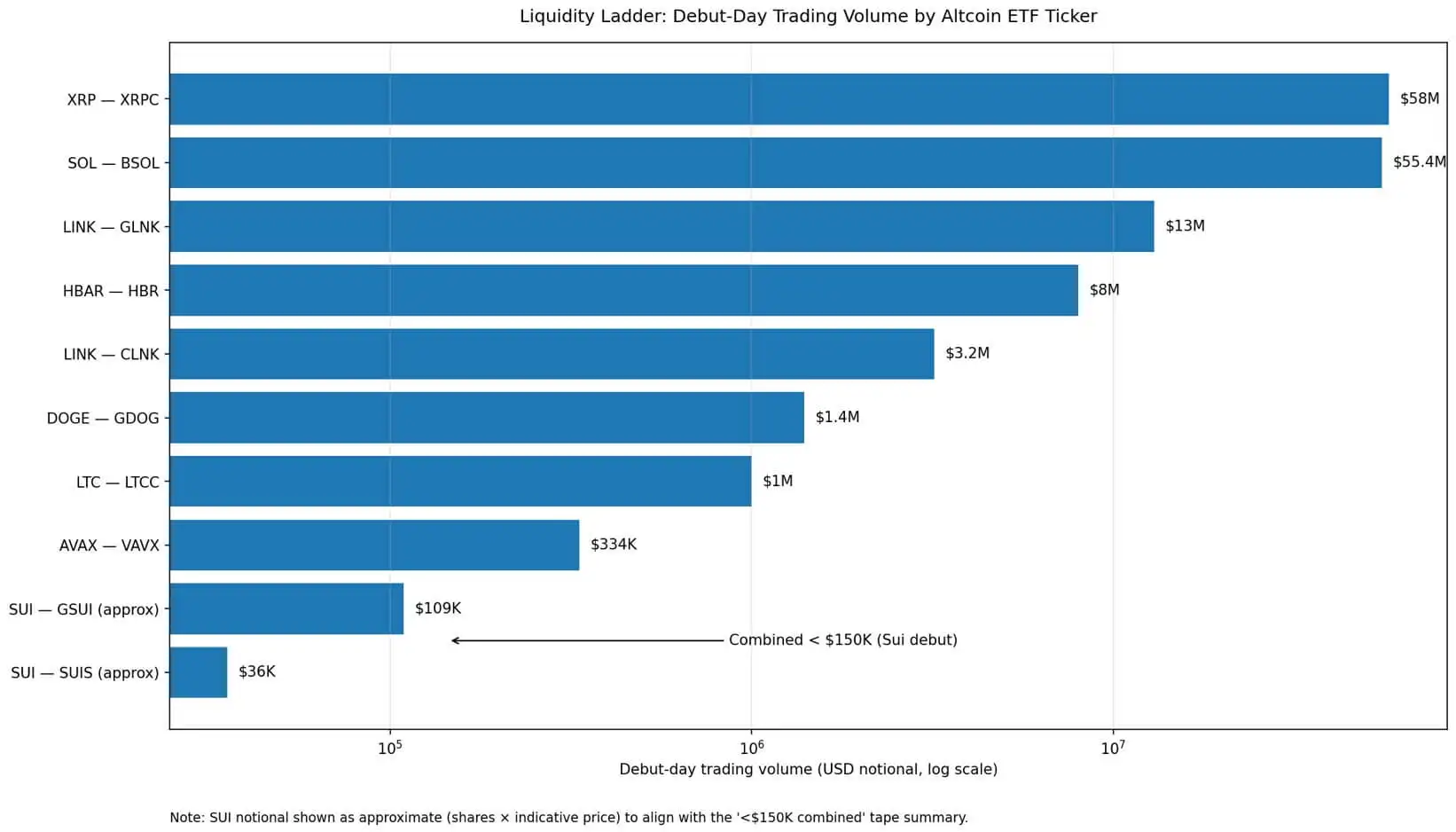

TokenSui ETFs just launched — and the volume is collapsing because nobodys showing up

Two spot Sui ETFs began trading in US markets on Feb. 18. Canary's SUIS is listed on Nasdaq, while G

2026-02-20 23:03

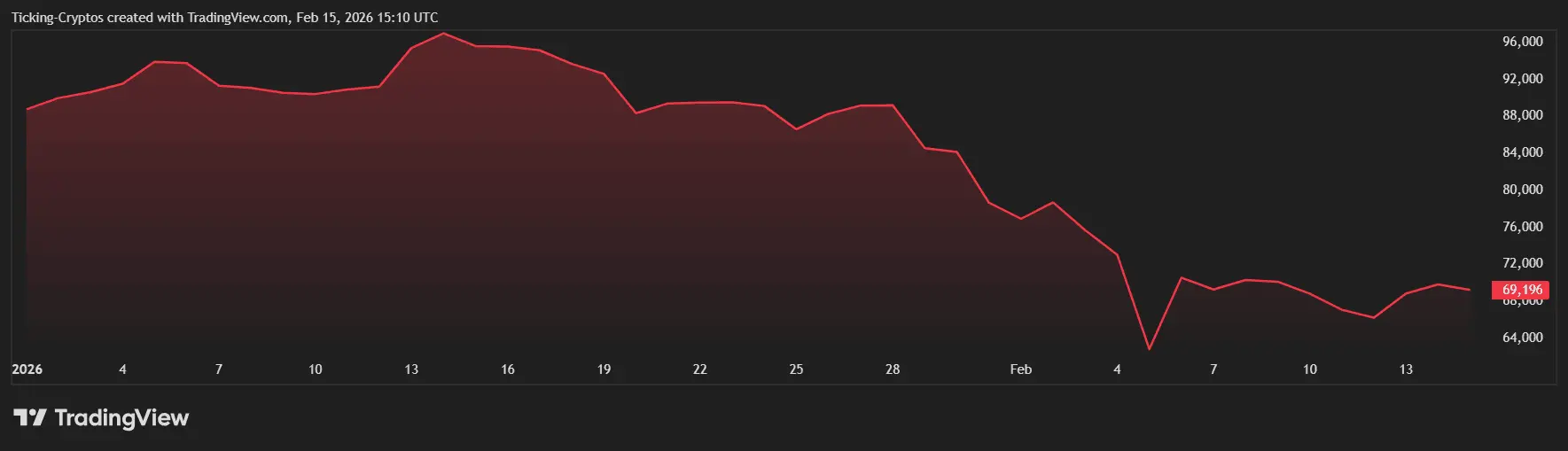

TokenBitcoin selloff due to quantum fears doesnt add up with Ether flat, says dev

Bitcoin‘s recent sell-off isn’t because of quantum computing fear, because if that were the case, Et

2026-02-20 11:03

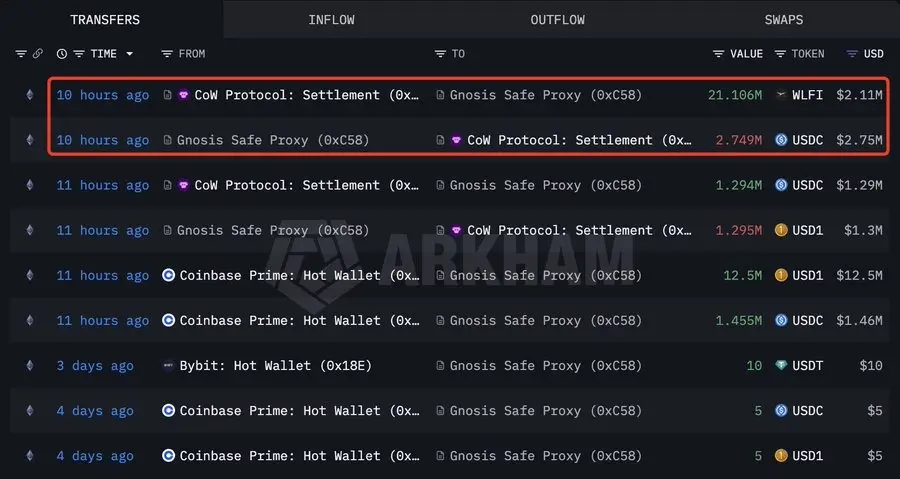

ExchangeWhy World Liberty Financial WLFI token price up today?

Story Highlights World Liberty Financial $WLFI price surged 20% despite overall crypto market showi

2026-02-18 18:00

TokenBitMine Scoops Up $91M in Ethereum While Tom Lee Flags Market Mood Similar to Prior Bottoms - Crypto Economy

TL;DR:The company acquired an additional 45,759 $ETH, reaching a total of 4.3 million tokens in its

2026-02-18 06:02

ExchangeTop 10 Cryptos Defying the 2026 Crash: UP Despite the Bitcoin Crash

The 2026 "Hard Reset" has seen $Bitcoin drop below $70,000 due to institutional de-leveraging and ET

2026-02-16 16:00

TokenLINEA price is up 24%: heres what analysts predict could happen next

$LINEA has surged 24% amid strong social engagement and trading volume.The launch of trustless agent

2026-02-12 20:02

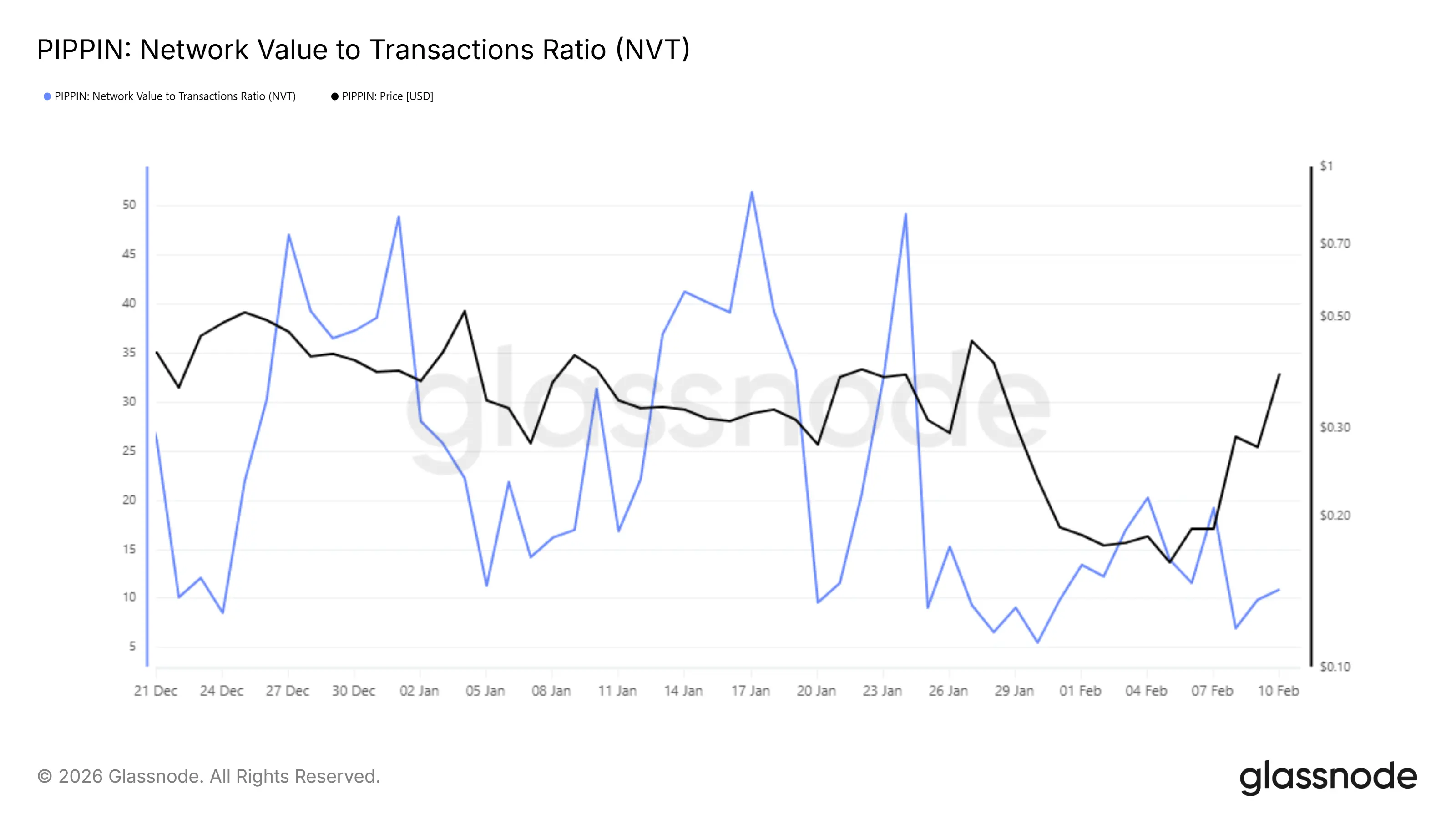

TokenPIPPIN Price Up 159% — Is Selling About to Slow the Rally?

$PIPPIN price has staged a powerful rally, pushing the meme coin closer to its all-time high. While

2026-02-12 02:02

1 ratings