CREDIT

$ 0.00 USD

$ 0.00 USD

$ 0.00 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

$ 0.00 USD

0.00 0.00 CREDIT

PROXI-related information

Issue Time

2020-08-21

Platform pertained to

--

Current coin price

0.00

Market Cap

$0.00USD

Volume of Transaction

24h

$0.00USD

Circulating supply

0.00CREDIT

Volume of Transaction

7d

$0.00USD

Change

24h

+2.86%

Number of Markets

Github Messages

More

Warehouse

Janusz Gregorczyk

Github's IP Address

[Copy]

Codebase Size

8

Last Updated Time

2021-01-04 12:48:51

Language Involved

Objective-C

Agreement

Other

Crypto token price conversion

Current Rate0

0.00USD

WikiBit Risk Alerts

1WikiBit has marked the token as air coin project for we have received overwhelming complaints that this token is a Ponzi Scheme. Please be aware of the risk!

CREDIT Price Chart

PROXI introduction

Markets

Markets3H

+3.72%

1D

+2.86%

1W

+12.27%

1M

-3.65%

1Y

-71.16%

All

-98.31%

| Aspect | Information |

|---|---|

| Short Name | CREDIT |

| Full Name | Terra Credit |

| Founded Year | 2018 |

| Main Founders | Daniel Schwartzkopff |

| Support Exchanges | Binance, Huobi, OKEx |

| Storage Wallet | MyEtherWallet, Ledger Wallet |

Overview of CREDIT

CREDIT, also known as Terra Credit, is a type of digital cryptocurrency that was established in 2018 by its main founder, Daniel Schwartzkopff. This coin is supported by various notable crypto exchanges such as Binance, Huobi, and OKEx. Users looking to store CREDIT can utilise options like MyEtherWallet and Ledger Wallet. It is fundamental to understand that as with all cryptocurrencies, investing in CREDIT carries numerous considerations including volatility of value, and it's always suggested to carry out thorough research before any kind of investment.

VIDEO URL LINK:https://proxidefi.com/wp-content/uploads/PROXI-Cross-Chain-Derivative-Issuance-Credit-Lending.mp4

Pros and Cons

| Pros | Cons |

|---|---|

| Supported by Major Exchanges | Subject to Market Volatility |

| Wide Range of Storage Options | Potential for Low Liquidity |

| Developed by Established Founder | Not Extensively Backed by Tangible Assets |

Pros:

1. Supported by Major Exchanges: CREDIT token has garnered support from major cryptocurrency exchanges such as Binance, Huobi, and OKEx. This indicates acceptance and recognition from globally renowned platforms, contributing to its accessibility and exposure to potential investors.

2. Wide Range of Storage Options: Storage is a key aspect when managing cryptocurrencies. CREDIT offers a wide range of storage options, including popular wallets like MyEtherWallet and Ledger Wallet. This diversity in storage solutions provides users flexibility, enhancing their overall experience.

3. Developed by Established Founder: Backed by established founder Daniel Schwartzkopff, CREDIT benefits from his expertise and experience in the domain. His involvement can be seen as an indicator of some level of stability and credibility.

Cons:

1. Subject to Market Volatility: Like all cryptocurrencies, CREDIT is subject to extreme market volatility. The value of the token can rise or fall drastically in a very short span of time, which implies potential risk for investors.

2. Potential for Low Liquidity: Depending on market circumstances, there might be situations where CREDIT faces liquidity issues. If many investors decide to sell their CREDIT tokens simultaneously, it may be difficult to find buyers, which can reduce its price steadily.

3. Not Extensively Backed by Tangible Assets: CREDIT, like most other cryptocurrencies, isn't extensively backed by tangible assets. Its value is mainly driven by supply, demand, and investor perception, which pose considerable uncertainty and possible instability.

What Makes CREDIT Unique?

CREDIT, also known as Terra Credit, introduces several innovations within the cryptocurrency landscape. It is built on the idea of creating a fast, decentralized blockchain solution for the community.

One key distinguishing factor of CREDIT is its block creation speed. It creates blocks in just 60 seconds, which is significantly faster than traditional cryptocurrencies such as Bitcoin. This quick block creation allows for swift transactions, contributing to the overall efficiency of the system.

Another unique aspect is its approach to consensus. While traditional cryptocurrencies use Proof of Work (PoW) or Proof of Stake (PoS) consensus algorithms, CREDIT employs a unique proprietary protocol. This protocol aims to limit the energy-intensive process seen in PoW systems, and attempts to avoid the wealth concentration seen in PoS systems. Thus, it strives to create a more balanced, energy-efficient blockchain.

Despite its unique aspects, it is crucial to mention that, like all cryptocurrencies, CREDIT is subject to market volatility, liquidity problems, and investment risks. The use and acceptance of CREDIT are still growing, and so is its journey towards maturation in the ever-evolving crypto market.

How Does CREDIT Work?

The CREDIT token is the native token of the PROXI DeFi platform. It is used for governance, staking, collateralization, and fee payments. Users can create synthetic assets on PROXI by depositing CREDIT into the asset creation pool. Synthetic assets can be traded on the PROXI exchange, and CREDIT is used to pay fees for these trades. Users can borrow assets from the PROXI lending pool by depositing CREDIT as collateral. CREDIT holders can vote on governance proposals to shape the future of the platform, and they can stake their tokens to earn rewards and support the security of the network.

Circulation of CREDIT

CREDIT is the native token of the PROXI DeFi platform. It has a total supply of 1 billion tokens, of which 25% was allocated to the private sale, 30% to the public sale, and 45% to the team, ecosystem, and treasury. The current circulating supply of CREDIT is around 250 million tokens. The price of CREDIT has fluctuated significantly since its launch in early 2020. It reached an all-time high of over $1 in February 2021, but has since fallen back to around $0.20. There is no mining cap for CREDIT, but the emission of new tokens is controlled by the PROXI governance protocol. The governance protocol sets a target inflation rate for CREDIT, which is currently set at 5%.

Exchanges to Buy CREDIT

Several exchanges enable users to purchase CREDIT tokens. Here are ten of them:

1. Binance: One of the world's largest cryptocurrency exchanges by trading volume, Binance supports CREDIT trading. The exchange usually offers popular pairs like CREDIT/USDT and CREDIT/BTC.

2. Huobi: A globally recognized cryptocurrency exchange, Huobi supports trading with the CREDIT token. Common trading pairs could include CREDIT/USDT and CREDIT/ETH.

3. OKEx: Known for its wide array of digital assets on offer, OKEx provides CREDIT trading as part of its platform. Frequent trading pairs consist of CREDIT/USDT and CREDIT/BTC.

4. Bitfinex: A major player in the digital currency market, Bitfinex lists CREDIT for trading. Available trading pairs often include CREDIT/USD and CREDIT/BTC.

5. KuCoin: Often dubbed the “People's Exchange”, KuCoin supports CREDIT trading on its platform as well. CREDIT/BTC and CREDIT/USDT are some typical pairs.

6. Gate.io: A digital asset exchange that supports a plethora of cryptocurrencies, including CREDIT. Known pairings on this exchange may involve CREDIT/USDT.

7. Bittrex: A secure, reliable and advanced digital asset trading platform that supports CREDIT. Available trading pair mainly involves CREDIT/BTC and CREDIT/USDT.

8. Poloniex: A cryptocurrency exchange offering a wide variety of digital assets, Poloniex lists CREDIT on its exchange. CREDIT/BTC is a common pair.

9. Kraken: Known for its strong security standards, Kraken supports CREDIT token trading. Common trading pairs could include CREDIT/USD and CREDIT/EUR.

10. Coinone: A South Korea based exchange that also supports CREDIT token trading. It offers common trading pairs like CREDIT/KRW.

Please note that trading pairs can vary and one should check the exchange's official website or trading platform for the most accurate and up-to-date trading pairs.

How to Store CREDIT?

Storing CREDIT, like other cryptocurrencies, involves keeping them safely in digital wallets that are protected with unique keys. Here are few wallets that are typically used to store CREDIT:

1. MyEtherWallet: Also commonly referred to as MEW, it's an open-source, free-to-use wallet which allows anyone to create wallets that operate on the Ethereum blockchain. It's a client-side interface, which ensures that users are in control of their keys at all times.

2. Ledger Wallet: A hardware wallet that provides a secure means of storing digital assets offline. Ledger's different iterations like Ledger Nano S or Ledger Nano X are popular among cryptocurrency users.

3. Metamask: Metamask is a software cryptocurrency wallet used to interact with the Ethereum blockchain. It allows users to access their Ethereum wallet through a browser extension or mobile app, enabling them to store, send and receive Ether and ERC20 tokens like CREDIT.

4. Trust Wallet: An secure and decentralized mobile wallet that supports Ethereum and ERC20, ERC223 and ERC721 tokens, and hence, can be used for CREDIT.

5. Trezor: This is a hardware wallet, very similar to Ledger in purpose. Trezor provides secure cold storage, keeping your CREDIT offline and safe.

Before proceeding with any of these wallets, it's essential to understand that security is paramount. Keep your private keys, passwords, and backup phrases secure and safe. Also, ensure that the wallets are updated to their latest versions. Wallet selection should be done based on personal requirements, ease of use, cost, security and the level of anonymity provided.

Should You Buy CREDIT?

The purchase of CREDIT, or any cryptocurrency, can be suitable for a variety of individuals, contingent upon their risk tolerance, investment horizon, financial goals, and understanding of crypto markets.

1. Tech Enthusiasts: Individuals who are passionate about blockchain technology and its potential may be keen on purchasing CREDIT. The unique consensus algorithm and quick block creation time make it an intriguing proposition to those who understand and appreciate these technical details.

2. Long-term Investors: Cryptocurrency investments are often volatile and uncertain in the short term. Long-term investors who can withstand the market's volatility and are willing to hold their investments for a significant duration may be better suited for investing in CREDIT.

3. Speculative Traders: Traders who engage in speculation, betting on price movements of cryptocurrencies could also consider CREDIT as one of their trading options.

However, investing in cryptocurrencies like CREDIT should always come with the understanding of risks attached to it. Here are some professional advices to potential investors:

1. Due Diligence: Before purchasing CREDIT, potential buyers should do their research. This includes understanding how CREDIT works, its unique selling points, as well as the potential risks.

2. Risk Management: Cryptocurrencies are known for their volatility, and CREDIT is not an exception. Potential buyers should invest only what they can afford to lose. Diversification may be a key factor in managing these risks.

3. Consulting Professionals: Since the cryptocurrency market can be complex and volatile, buyers should consider speaking with a financial advisor or professional who understands these markets before investing significant amounts.

4. Be Informed: Always follow market trends, news regarding legislation and regulation, changes in technology, and other factors that can affect CREDIT's value.

5. Security: If you decide to purchase CREDIT, ensure that your tokens are stored in a secure wallet. Protect your private keys and do not share them with anyone.

Remember, all investments carry some risk and investing in cryptocurrencies like CREDIT is no different.

Conclusion

CREDIT, otherwise known as Terra Credit, is a fairly recent addition to the cryptocurrency scene. It introduces innovations such as fast block creation and a unique consensus protocol, distinguishing itself from many existing cryptocurrencies. Its development has been supported by major crypto exchanges like Binance, Huobi and OKEx, and there are several wallets available for securely storing CREDIT.

The development prospects of CREDIT seem promising, given its unique technology and acceptance by multiple platforms. However, the trajectory of any new cryptocurrency lies with many volatile factors, such as market trends, regulatory norms, and widespread adoption by users and investors.

As for the question of making money or appreciating in value, it is important to note that, like all cryptocurrencies, CREDIT's value is highly volatile. This could lead to potential gains but could also result in substantial losses. Therefore, investing in CREDIT, just like with any other type of investment, requires careful consideration, balanced risk management, thorough research, and professional advice if possible.

As always, individuals interested in investing in CREDIT should do their own research and consult with a qualified professional before making any decisions. The cryptocurrency market's state will always be volatile and unpredictable, and it's crucial for prospective investors to be prepared for any possible outcomes.

FAQs

Q: What is the primary purpose of CREDIT?

A: CREDIT aims to provide a fast, decentralized blockchain solution by offering quicker block creation and a unique consensus protocol to its users.

Q: How does the value of CREDIT vary?

A: Similar to other cryptocurrencies, the value of CREDIT is subject to substantial market volatility.

Q: What unique aspect does CREDIT bring to the cryptocurrency market?

A: Unique aspects of CREDIT include faster block creation (60 seconds) and a proprietary consensus protocol aiming to establish a more balanced, energy-efficient blockchain.

Q: What is the potential liquidity issue related to CREDIT?

A: There could potentially be situations where CREDIT may face liquidity issues if a large number of investors simultaneously decide to sell their CREDIT tokens.

Q: What precautionary steps should be considered while investing in CREDIT?

A: Investors should carry out due diligence, practice risk management, consult professionals, keep abreast of market trends, and ensure secure storage methods while investing in CREDIT.

Q: What does the future growth outlook of CREDIT seem like?

A: Although CREDIT demonstrates promising technical aspects, future growth heavily depends on factors like market trends, regulations, and the extent of user and investor adoption, which are unpredictable.

Risk Warning

Investing in cryptocurrencies requires an understanding of potential risks, including unstable prices, security threats, and regulatory shifts. Thorough research and professional guidance are advised for any such investment activities, recognizing these mentioned risks are just part of a wider risk environment.

PROXI User Reviews

PROXI News

ExchangeLemon launches Bitcoin-backed credit card in cash-hoarding Argentina

Lemon, one of Argentina‘s largest crypto exchanges, has launched what it describes as the country’s

2026-01-15 18:00

ExchangeCredit unions reject stablecoin rewards, bitcoin traders look to inflation data: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)U.S. credit unions joined banks in rejecti

2026-01-13 22:25

TokenCircle Partners Intuit to Bring Stablecoin Services to Credit Karma, Turbotax, Quickbooks

Key NotesPartnership aims to transform refunds, remittances, savings and payments using blockchain i

2025-12-19 02:03

TokenStrategy unveils new credit gauge to calm debt fears after Bitcoin crash

Strategy launched a BTC rating dashboard, claiming another 70 years of financial runway to service its debt, aiming to soothe investor concerns over forced bear market liquidations.

2025-11-26 21:25

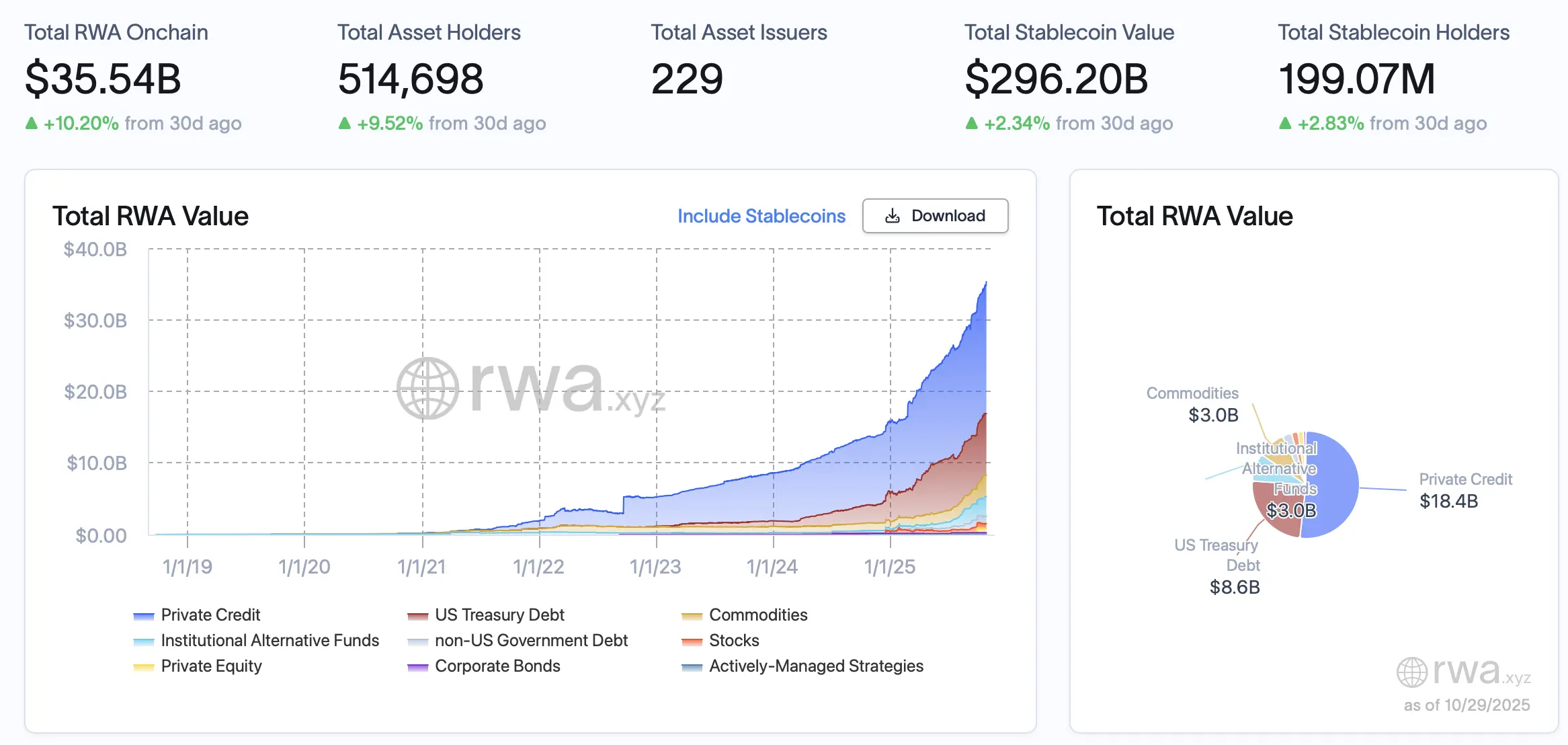

TokenSecuritize, BNY Mellon launch tokenized fund backed by structured credit

Securitize, a real-world asset tokenization platform, has unveiled a tokenized fund designed to give

2025-10-30 08:02

TokenCould a Government Shutdown Downgrade the US Credit Rating?

The US government shutdown is threatening to be a long one, which may cause rating agencies to downg

2025-10-02 03:02

ExchangeCleanSpark secures second BTC-backed credit line this week without share dilution

CleanSpark opens a second $100 million Bitcoin-backed credit facility in one week, expanding lending capacity to $400 million while avoiding shareholder dilution.

2025-09-26 00:30

ExchangeVC Roundup: VCs fuel energy tokenization, AI datachains, programmable credit

This months VC Roundup spotlights Plural, Irys, Credit Coop, Yellow Network and Utila as venture capital flows into tokenization and stablecoin infrastructure.

2025-09-05 01:03

TokenXRP Ledger at Core of VERTs Strategy for $500M in Tokenized Private Credit Pipeline

XRP Ledger is powering a $130 million breakthrough in Brazils private credit markets, with over $500

2025-07-24 10:06

9 ratings